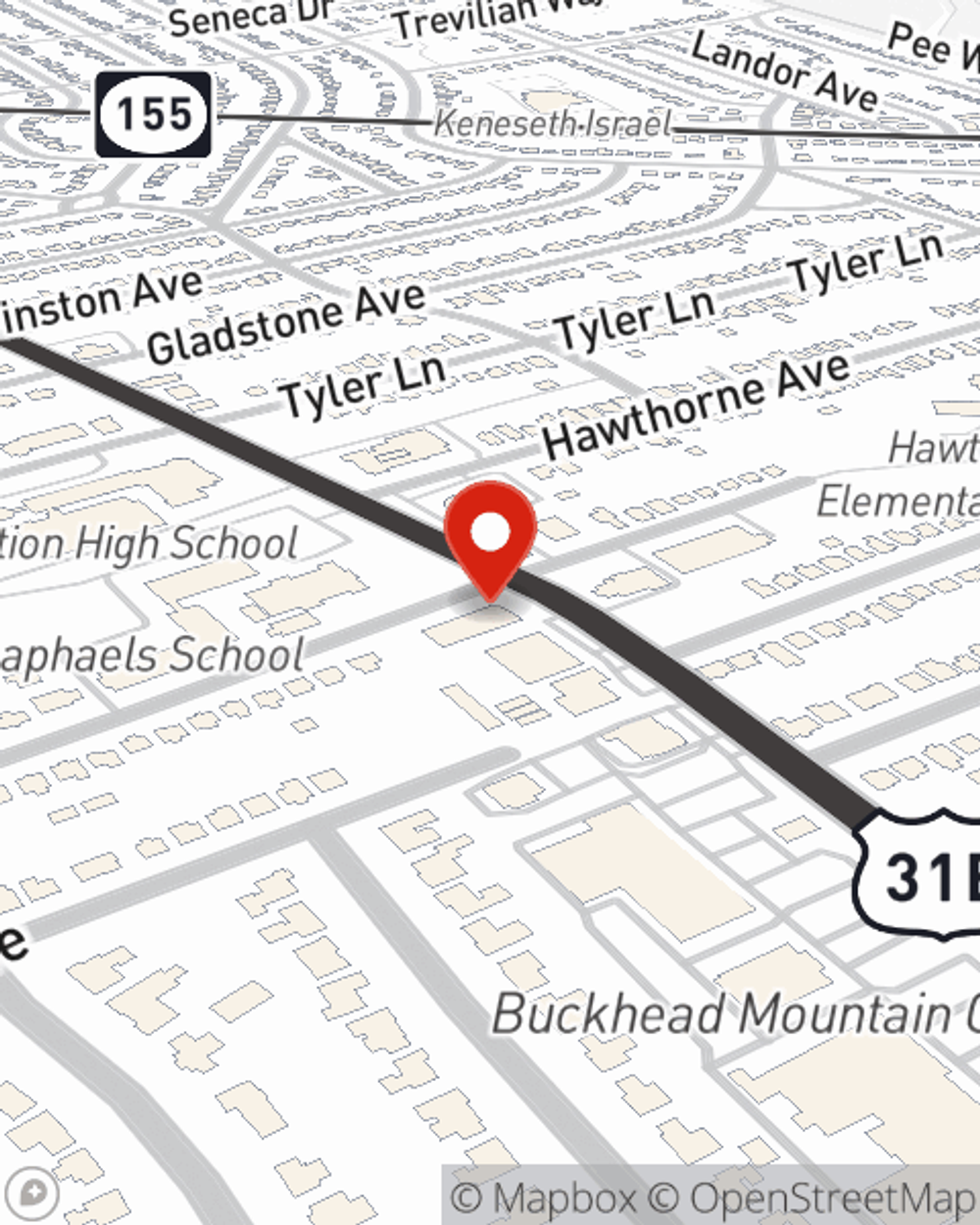

Business Insurance in and around Louisville

Get your Louisville business covered, right here!

This small business insurance is not risky

- Louisville

- Jefferson County

- Oldham County

- Shelby County

- Highlands

- Seneca

- Germantown

- Nulu

- Bullitt County

- Spencer County

- Old Louisville

- St. James

This Coverage Is Worth It.

Preparation is key for when a mishap happens on your business's property like an employee getting hurt.

Get your Louisville business covered, right here!

This small business insurance is not risky

Surprisingly Great Insurance

With options like errors and omissions liability, a surety or fidelity bond, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Sam Wheeler is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Intrigued enough to investigate the specific options that may be right for you and your small business? Simply contact State Farm agent Sam Wheeler today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Sam Wheeler

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.